In today’s volatile financial landscape, understanding silver price trends through reliable platforms like Fintechzoom has become crucial for savvy investors. Amidst economic uncertainties and market fluctuations, silver continues to shine as both a precious metal for investment and an industrial commodity.

This comprehensive guide explores the intricacies of monitoring silver prices, making informed investment decisions, and leveraging Fintechzoom’s powerful tools for market analysis.

Why Monitor Silver Prices on Fintechzoom?

Fintechzoom has established itself as a cornerstone platform for tracking precious metal prices, particularly silver. The platform’s sophisticated infrastructure combines real-time data updates with comprehensive market analysis, making it an invaluable resource for investors at all levels.

What truly sets Fintechzoom apart is its ability to aggregate data from multiple reliable sources, providing investors with a complete picture of the silver market.

The platform’s cutting-edge features include real-time price tracking with minute-by-minute updates, advanced charting capabilities enhanced with technical indicators, and expert market commentary that helps investors make informed decisions.

Moreover, Fintechzoom’s historical data comparison tools enable investors to identify patterns and trends that might influence future price movements.

Key features that set Fintechzoom apart include:

- Real-time price tracking with minute-by-minute updates

- Advanced charting tools with technical indicators

- Expert market commentary and analysis

- Historical data comparisons

- Custom price alerts and notifications

Understanding Factors That Influence Silver Prices

Supply and Demand Dynamics

The silver market’s complexity stems from its dual role as both an industrial metal and an investment vehicle. Industrial demand, particularly from electronics and solar panel manufacturers, accounts for roughly 50% of annual silver consumption. The remaining demand comes from jewelry, silverware, and investment products.

Recent market data indicates that industrial demand reached unprecedented levels, hitting 508.2 million ounces in 2023, marking a significant increase from previous years.

The growing adoption of green technologies has further amplified industrial demand. Solar panel manufacturers alone consume millions of ounces annually, and this demand is expected to increase as countries worldwide push for renewable energy solutions.

Economic Uncertainty and Inflation

During periods of economic turbulence, silver often serves as a safe haven asset, protecting investors against inflation and currency devaluation. The 2020 pandemic perfectly illustrated this relationship, with silver prices surging over 47% between March and August 2020. This remarkable performance demonstrated silver’s ability to preserve wealth during times of economic stress.

Today’s investors increasingly view silver as an essential portfolio diversification tool, particularly given ongoing concerns about inflation and economic stability. The metal’s historical performance during inflationary periods makes it an attractive option for those seeking to protect their wealth against currency devaluation.

Also Read: The Digital Revolution: How Analytics is Transforming Insurance – TheStudyPoints Guide 2024

Currency Exchange Rates and Geopolitical Events

The global silver market primarily trades in U.S. dollars, making exchange rates a crucial factor for international investors. When the dollar weakens, silver typically becomes more affordable for foreign buyers, potentially increasing demand and driving prices higher. Conversely, a stronger dollar can make silver more expensive in other currencies, potentially dampening demand.

Historical Analysis of Silver Prices

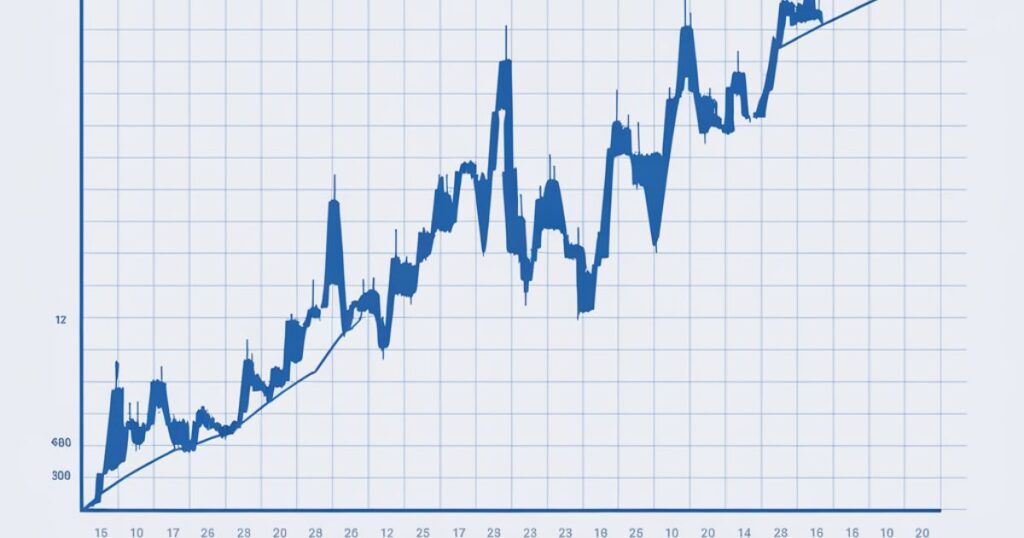

The past decade has revealed remarkable volatility in silver prices, offering valuable lessons for investors. Here’s a detailed analysis of significant price movements:

| Year | Key Event | Price Impact | Market Reaction |

| 2011 | Post-Financial Crisis Peak | $48.70/oz | Massive Surge |

| 2015 | Commodity Market Slump | $14.62/oz | Sharp Decline |

| 2020 | Pandemic Surge | $28.32/oz | Strong Rally |

| 2023 | Green Energy Demand | $23.95/oz | Steady Growth |

Silver Prices in the Last Five Years

Between 2018 and 2023, silver prices demonstrated remarkable resilience despite global challenges. The market weathered significant disruptions, including the global pandemic, supply chain issues, and geopolitical tensions. These events created a complex trading environment where prices responded to both traditional market forces and unprecedented global circumstances.

The green energy revolution has emerged as a major price driver during this period. Solar panel manufacturers have significantly increased their silver consumption, creating a new and growing demand source. This industrial demand, coupled with investment interest, has helped maintain price stability even during challenging market conditions.

The market saw increased volatility due to:

- Global pandemic impacts

- Supply chain disruptions

- Growing industrial demand

- Technological advancement in green energy

Investing in Silver: Short-Term vs. Long-Term Strategies

Short-Term Investment Approach

Short-term silver trading requires precise timing and detailed technical analysis. Successful traders typically monitor price momentum indicators, trading volumes, and market sentiment while staying attuned to breaking news that could impact prices. This approach demands active management and a deep understanding of market dynamics.

Successful traders often focus on:

- Price momentum indicators

- Trading volume analysis

- Market sentiment tracking

- Technical chart patterns

Long-Term Investment Strategy

Long-term silver investors focus more on fundamental factors and macro trends. They consider industrial demand growth, global economic conditions, and silver’s role in portfolio diversification. This approach typically involves regular purchasing regardless of short-term price fluctuations, a strategy known as dollar-cost averaging.

How Fintechzoom Helps in Predicting Silver Prices

Fintechzoom’s sophisticated platform offers comprehensive tools that transform raw data into actionable insights. The platform’s predictive capabilities combine technical analysis indicators with fundamental market data, helping investors identify potential price movements before they occur.

Their advanced charting system includes momentum indicators, moving averages, and trend analysis tools that provide a clear picture of market dynamics.

What makes Fintechzoom particularly valuable is its integration of market sentiment analysis. The platform aggregates news, social media trends, and expert opinions to provide a holistic view of market sentiment.

This multi-faceted approach helps investors understand not just where prices are, but where they might be heading.

Fintechzoom’s platform offers sophisticated tools for price prediction, including:

- Advanced technical analysis indicators

- Pattern recognition algorithms

- Market sentiment analysis

- Expert price forecasts

Comparing Silver with Other Precious Metals

Silver vs. Gold Investment Analysis

While gold often captures headlines, silver presents unique investment characteristics that merit careful consideration. Its lower price point makes it more accessible to retail investors, while its higher volatility offers greater potential for percentage gains. Unlike gold, silver’s substantial industrial demand adds another dimension to its price dynamics.

The gold-to-silver ratio, historically averaging around 65:1, serves as a valuable metric for investors. When this ratio deviates significantly from historical norms, it can signal potential investment opportunities in either metal. Currently, many analysts suggest that silver appears undervalued compared to gold, potentially offering better value for new investments.

Silver vs. Platinum: Industrial Uses

Silver’s industrial applications continue expanding, particularly in emerging technologies. While platinum remains crucial for automotive catalytic converters, silver’s conductivity and antimicrobial properties make it indispensable in electronics, solar panels, and medical devices. The growing adoption of 5G technology and Internet of Things (IoT) devices further increases silver demand in the electronics sector.

The Future of Silver Prices: Expert Predictions

Industry experts maintain an optimistic outlook for silver prices, citing several key factors. The expansion of renewable energy infrastructure, particularly solar power, is expected to drive significant demand growth. The International Energy Agency projects solar capacity to triple by 2027, potentially requiring substantial silver supplies.

Additionally, the emergence of new technologies, including electric vehicles and 5G networks, creates additional demand sources. These factors, combined with potentially constrained mining supply, could support higher prices in the coming years.

Industry experts project strong potential for silver prices, citing:

- Growing renewable energy demand

- Increasing industrial applications

- Limited mining supply

- Investment demand growth

Essential Tips for New Investors

For those just starting their silver investment journey:

- Start with small, regular investments

- Diversify across different forms of silver

- Monitor market trends regularly

- Consider storage solutions carefully

- Stay informed through reliable platforms like Fintechzoom

Conclusion

Understanding silver prices through Fintechzoom’s comprehensive platform empowers investors to make well-informed decisions in this dynamic market. The combination of industrial demand, investment interest, and technological advancement creates a complex but potentially rewarding investment landscape.

Success in silver investing requires staying informed about market trends, understanding price drivers, and maintaining a disciplined investment approach. Fintechzoom’s tools and resources provide the necessary foundation for developing and executing effective investment strategies.

Remember: that while silver offers significant potential benefits, it should be part of a diversified investment portfolio aligned with your financial goals and risk tolerance. Regular monitoring of market conditions and staying updated with reliable analysis through platforms like Fintechzoom can help optimize your investment outcomes.

Explore the latest news and insights from Echozynth and beyond at Echozynth.com

Kiara Arushi is the dedicated admin of this personal website, which serves as a comprehensive hub for general information across various topics. With a keen eye for detail and a passion for knowledge sharing, Kiara curates content that is both informative and engaging, catering to a diverse audience.

Her commitment to providing accurate and up-to-date information ensures that visitors find valuable insights and practical tips in every post. Whether you’re seeking the latest trends or timeless advice, Kiara’s expertise makes this site a trusted resource for all.