Introduction to FintechZoom SP500

In today’s rapidly evolving financial landscape, FintechZoom has emerged as a groundbreaking platform that’s revolutionizing how investors interact with the SP500 index.

The convergence of traditional finance and cutting-edge technology has created an unprecedented opportunity for both novice and seasoned investors to access, analyze, and act on market movements with remarkable precision.

The platform represents a significant leap forward in financial technology, combining advanced artificial intelligence capabilities with user-friendly interfaces to democratize access to one of the world’s most watched market indices.

As we navigate through the complexities of modern investing, FintechZoom’s innovative approach to SP500 analysis has become increasingly vital for making informed investment decisions.

What is FintechZoom SP500 and its Importance in the Global Stock Market?

At its core, FintechZoom SP500 serves as a sophisticated digital gateway to the Standard & Poor’s 500 Index, representing the performance of the top 500 publicly traded companies in the United States.

This comprehensive platform transforms raw market data into actionable insights through its suite of analytical tools and real-time monitoring capabilities.

The significance of FintechZoom SP500 extends far beyond simple market tracking. It functions as a crucial market barometer, offering investors a detailed view of both macroeconomic trends and individual company performance.

In the context of global financial markets, the platform serves as an essential tool for understanding market dynamics and making strategic investment decisions.

Brief History and Significance of the FintechZoom SP500 Index

The evolution of the SP500 index since its introduction by Standard & Poor’s in 1957 represents one of the most significant developments in financial market history.

FintechZoom has modernized access to this crucial index, transforming it from a simple market measure into a dynamic, interactive tool for the digital age.

Table: Historical Milestones of SP500 Integration with FintechZoom

| Era | Development | Impact |

| 1957-2000 | Traditional SP500 Tracking | Basic market monitoring |

| 2000-2015 | Digital Integration | Enhanced data accessibility |

| 2015-Present | AI-Powered Analytics | Real-time insights and predictions |

Understanding the SP500 Index

The foundation of the FintechZoom platform lies in its comprehensive coverage of the SP500 index, which encompasses companies across various sectors including technology, healthcare, finance, and consumer goods. This diverse representation provides investors with a broad view of market performance and economic health.

The platform employs sophisticated algorithms to track and analyze the market capitalization-weighted index, considering factors such as company size, trading volume, and sector balance. This methodical approach ensures that users receive accurate, timely information about market movements and trends.

Also Read: Archivebate: Ultimate Tool for Exploring Archived Cam Show Content

Components and Criteria for Inclusion in the FintechZoom SP500 Index

The selection criteria for companies in the SP500 index are rigorous and multifaceted. FintechZoom provides detailed insights into these requirements, which include minimum market capitalization thresholds, adequate liquidity levels, and specific financial viability metrics.

The platform offers real-time updates when companies are added or removed from the index, helping investors stay informed about significant changes in market composition.

Table: SP500 Inclusion Criteria Tracked by FintechZoom

| Criterion | Requirement | Monitoring Tools |

| Market Cap | $13.1B minimum | Real-time tracking |

| Public Float | 10% minimum | Ownership analysis |

| Financial Viability | Four consecutive quarters of positive earnings | Financial health metrics |

How the Index is Calculated and its Role as a Market Indicator

FintechZoom employs sophisticated market analysis tools to track the SP500’s calculation methodology. The platform utilizes advanced algorithms to monitor the market capitalization-weighted approach, where larger companies have a proportionally greater impact on the index’s movement.

This complex calculation process is simplified through intuitive visualizations and real-time updates, making it accessible to investors of all experience levels.

The role of the index as a market indicator has evolved significantly in the digital age. Through FintechZoom’s interface, investors can observe how the SP500 serves as a leading indicator of economic health, corporate profitability, and market sentiment.

The platform’s analytical capabilities help users understand both short-term fluctuations and long-term trends, providing valuable context for investment decisions.

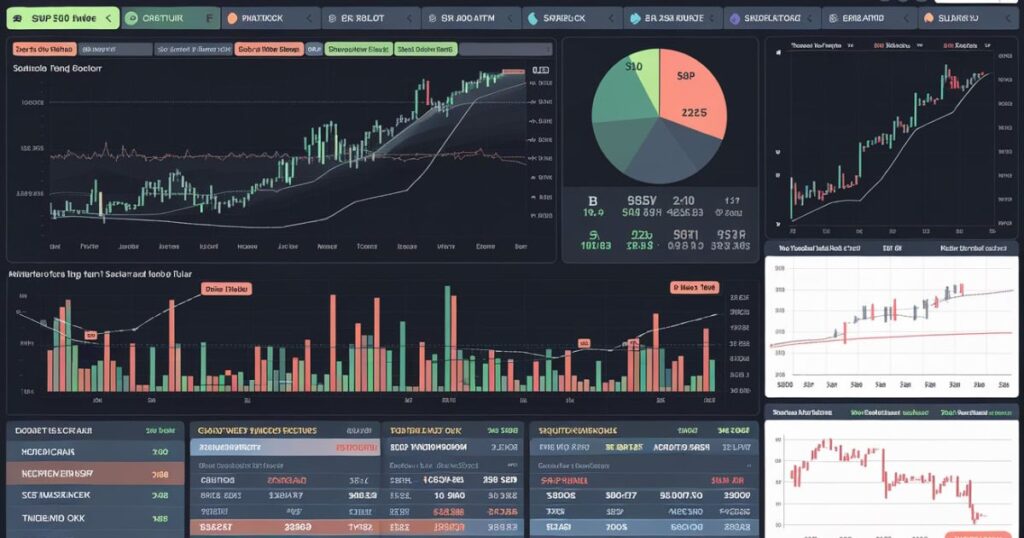

An In-Depth Look at FintechZoom’s S&P 500 Dashboard and Tools

The cornerstone of FintechZoom’s offering is its comprehensive dashboard, which integrates artificial intelligence and machine learning to deliver powerful market insights. The interface combines sophisticated analysis with user-friendly design, creating an environment where both novice and experienced investors can thrive.

Real-Time Market Data and Analysis Tools

FintechZoom’s platform excels in providing instantaneous market updates through its real-time data integration system. The platform processes millions of data points per second, offering investors immediate access to price movements, volume changes, and market trends.

Advanced analytical features include technical indicators, sentiment analysis, and predictive modeling tools that help users make informed decisions in rapidly changing market conditions.

Customizable Alerts and Notifications

The platform’s alert system represents a significant advancement in personalized market monitoring. Users can establish sophisticated notification parameters based on price movements, volume thresholds, technical indicators, and news events. These alerts can be delivered through multiple channels, ensuring investors never miss critical market developments.

Interactive Charts and Visualizations

FintechZoom’s visualization tools transform complex market data into clear, actionable insights. The platform offers a range of chart types, from traditional candlestick patterns to advanced technical analysis overlays.

These interactive features allow users to customize time frames, add technical indicators, and analyze historical patterns with remarkable precision.

Portfolio Management Features

The integrated portfolio management system represents a breakthrough in personal investment tracking. Through advanced risk assessment tools and performance analytics, investors can monitor their holdings against the broader market, optimize asset allocation, and identify potential opportunities for portfolio rebalancing.

Educational Resources and Market Insights

FintechZoom places significant emphasis on investor education through its comprehensive learning center. The platform offers detailed tutorials, market analysis reports, and expert commentary to help users develop their investment knowledge. These resources are regularly updated to reflect current market conditions and emerging trends in the financial technology sector.

Historical Performance and Key Milestones

Understanding historical context is crucial for informed investment decisions. FintechZoom provides detailed historical analysis capabilities, allowing users to examine market trends, economic cycles, and significant events that have shaped the SP500’s performance over time.

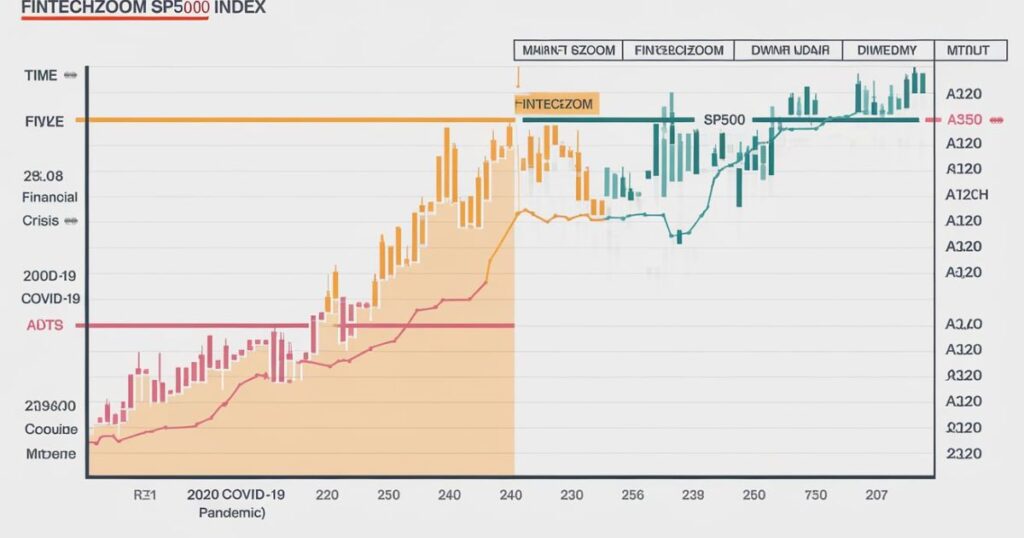

Notable Milestones and Historical Context of the FintechZoom SP500

The platform provides comprehensive coverage of pivotal moments in market history, from the bull markets of the 1980s and 1990s to the transformative events of recent decades. Through FintechZoom’s historical analysis tools, investors can study how major market events shaped the SP500’s evolution.

The platform’s interactive timeline feature highlights significant milestones, including the Dot-com Bubble burst, the 2008 Financial Crisis, and the unprecedented market dynamics during the COVID-19 pandemic.

Overview of Long-term Performance and Trends

FintechZoom’s trend analysis capabilities reveal the SP500’s remarkable long-term performance patterns. The platform’s sophisticated tracking tools show how the index has maintained an average annual return of approximately 7-10% when adjusted for inflation.

Through advanced data visualization features, investors can observe how various sectors have contributed to this growth and identify patterns that may influence future market behavior.

Impact of Economic Events and Crises

The platform excels in analyzing how major economic events affect market performance. FintechZoom’s comprehensive data analysis tools help investors understand market reactions to various types of crises and the subsequent recovery patterns.

Analysis of the FintechZoom SP500 During Major Economic Downturns and Recoveries

During significant market downturns, FintechZoom’s analytical capabilities become particularly valuable. The platform provides detailed insights into market behavior during various types of economic stress, helping investors understand potential risks and opportunities.

Through advanced machine learning algorithms, the platform can identify patterns in market recovery phases, offering valuable guidance for investment strategies during turbulent times.

How Geopolitical Events Affect the Index’s Performance

FintechZoom’s sophisticated news integration and analysis tools help investors understand the impact of geopolitical events on market performance. The platform tracks how international relations, trade policies, and global economic shifts influence SP500 movements, providing users with contextual understanding for more informed decision-making.

Fintech and Technological Advancements

The integration of cutting-edge technology sets FintechZoom apart in the financial analysis landscape. The platform leverages blockchain, artificial intelligence, and advanced data analytics to provide unprecedented market insights.

The Role of Fintech and Innovation in Shaping the FintechZoom SP500

Innovation drives continuous improvement in FintechZoom’s capabilities. The platform regularly integrates new technological advancements to enhance its analysis tools, user interface, and predictive capabilities.

These innovations have transformed how investors interact with market data, making sophisticated analysis tools accessible to a broader audience.

How Technological Advancements Influence Investment Strategies

The platform’s integration of automated trading systems and robo-advisors has revolutionized investment strategy development. FintechZoom’s advanced algorithms help users develop and test investment strategies, while machine learning capabilities assist in identifying market patterns and potential opportunities.

Also Read: One Providing Sat Navigation NYT: Revolutionizing Navigation in a Digital Age

Benefits of Using FintechZoom for SP 500 Investors

The platform offers transformative advantages for modern investors through its comprehensive suite of analytical tools. FintechZoom’s integrated approach combines real-time data analysis with sophisticated market insights, enabling investors to make more informed decisions.

The platform’s risk management capabilities help users understand market exposure and potential opportunities while maintaining portfolio balance.

Through advanced portfolio optimization techniques, FintechZoom helps investors achieve better diversification across sectors and asset classes. The platform’s intelligent algorithms continuously monitor market conditions, providing timely alerts and recommendations for portfolio adjustments based on changing market dynamics.

How FintechZoom Simplifies SP 500 Market Data for Investors

FintechZoom transforms complex market data into actionable insights through its intuitive interface. The platform’s data visualization tools make it easier for investors to understand market trends and patterns, while comprehensive analysis features help identify potential investment opportunities.

Real-Time Data Integration

The platform’s real-time analytics engine processes market data instantaneously, providing users with up-to-the-second information about market movements, trading volumes, and price changes. This immediate access to market information enables investors to react quickly to changing market conditions and make timely investment decisions.

Advanced Analytical Tools

FintechZoom’s suite of analytical tools includes sophisticated technical indicators, fundamental analysis features, and predictive modeling capabilities. These tools help investors identify market trends, analyze company performance, and evaluate potential investment opportunities with greater precision.

User-Friendly Interface

The platform’s intuitive design makes complex market analysis accessible to investors of all experience levels. Through thoughtful interface design and clear data presentation, FintechZoom ensures that users can easily navigate through various analytical tools and features without feeling overwhelmed.

Comprehensive Market Coverage

FintechZoom provides extensive coverage of the entire SP500 index, including detailed analysis of individual companies, sector performance, and broader market trends. This comprehensive approach ensures that investors have access to all the information they need to make well-informed investment decisions.

Educational Resources and Support

The platform’s commitment to investor education is evident in its extensive library of learning resources, including tutorials, market analysis guides, and expert insights. These educational materials help users better understand market dynamics and make more informed investment decisions.

FintechZoom and the SP 500: An Essential Tool for Market Analysis

Table: FintechZoom’s Core Analytical Features

| Feature Category | Key Components | Benefits |

| Market Analysis | Technical Indicators, Pattern Recognition | Enhanced Trading Decisions |

| Risk Management | Portfolio Analytics, Diversification Tools | Better Risk Control |

| Educational Resources | Tutorials, Expert Analysis, Market Guides | Improved Market Understandin |

Comprehensive Market Insights

FintechZoom’s market analysis capabilities provide deep insights into SP500 performance through advanced data analytics. The platform excels in identifying market trends, sector rotations, and potential investment opportunities through its sophisticated monitoring systems. Investors gain access to comprehensive analysis of market fundamentals, technical indicators, and sentiment metrics that influence index movements.

Advanced Analytical Tools

The platform’s analytical suite combines artificial intelligence with traditional market analysis methods to provide superior insights. These tools include predictive analytics for market trends, risk assessment modules, and performance tracking systems that help investors make data-driven decisions.

The integration of machine learning algorithms enables the platform to identify complex market patterns and potential trading opportunities.

Table: FintechZoom’s Advanced Analytics Framework

| Analytics Category | Features | Application |

| Predictive Analysis | AI-Driven Forecasting, Pattern Recognition | Future Trend Prediction |

| Risk Analytics | Portfolio Stress Testing, Risk Scoring | Risk Management |

| Performance Tracking | Real-time Monitoring, Historical Analysis | Investment Optimization |

Educational Support

FintechZoom’s commitment to investor education manifests through its comprehensive learning ecosystem. The platform offers structured learning paths, from basic market concepts to advanced trading strategies. Regular webinars, expert-led sessions, and interactive tutorials help users enhance their investment knowledge and skills.

Collaboration and Community Engagement

The platform fosters a vibrant community of investors through its social features. Users can participate in discussion forums, share investment strategies, and learn from experienced traders. This collaborative environment enhances the learning experience and provides valuable peer insights into market dynamics.

Using FintechZoom for S&P 500: A Step-by-Step Overview

The platform provides a structured approach to SP500 investing through its intuitive interface. New users begin with a comprehensive onboarding process that introduces key features and functionality. The systematic approach ensures that investors can effectively utilize all platform capabilities for their investment goals.

Navigating the Platform

The user interface is designed for efficient navigation through various analytical tools and features. Clear categorization and intuitive menu structures help users quickly access needed information and tools. The platform’s responsive design ensures seamless operation across different devices and screen sizes.

Customizing Your Dashboard

Users can create personalized workspace layouts that reflect their investment focus and preferences. The customizable dashboard allows investors to arrange key metrics, charts, and alerts according to their specific needs. This flexibility helps maintain focus on crucial market indicators and portfolio performance metrics.

Conducting Market Research

FintechZoom provides comprehensive tools for market analysis and research. Investors can access detailed company profiles, sector analysis, and market trends through the platform’s research suite. The integration of multiple data sources ensures thorough and balanced market insights.

Analyzing Investment Opportunities

FintechZoom’s advanced screening tools enable sophisticated investment analysis through multiple lenses. The platform integrates fundamental analysis, technical indicators, and market sentiment data to provide comprehensive investment insights. Users can leverage artificial intelligence algorithms to identify potential opportunities aligned with their investment strategies and risk tolerance.

Optimizing Your Investment Strategy

The platform offers dynamic tools for strategy development and refinement. Through advanced backtesting capabilities, investors can evaluate the historical performance of their strategies under various market conditions. Real-time analytics help users adjust their approaches based on changing market dynamics and new opportunities.

Engaging with the Investor Community

FintechZoom’s community features facilitate knowledge sharing and collaborative learning. The platform hosts regular expert sessions, discussion forums, and strategy sharing opportunities. This collaborative environment helps investors benefit from collective wisdom while maintaining their individual investment approaches.

Monitoring and Adjusting Your Portfolio

The platform’s portfolio management tools provide continuous monitoring and analysis capabilities. Advanced risk metrics help investors understand their exposure across different market conditions. Regular rebalancing suggestions and performance analytics ensure portfolios remain aligned with investment objectives.

Forecast and Predictions

FintechZoom incorporates sophisticated predictive analytics to help investors understand potential market movements. The platform’s forecasting tools combine historical data analysis with advanced machine learning algorithms to identify possible market trends and opportunities.

Expert Insights on the Future Performance of the FintechZoom SP500

Leading market analysts contribute regular insights through the platform’s expert network. These perspectives, combined with FintechZoom’s analytical tools, provide users with comprehensive views on potential market developments. The platform’s integration of expert analysis with quantitative data helps investors make more informed decisions.

Predictions for Upcoming Trends and Market Movements

The platform’s trend analysis capabilities help identify emerging market patterns and potential shifts in sector leadership. Through advanced data modeling, FintechZoom provides insights into possible market scenarios and their implications for investment strategies.

FintechZoom SP500 vs. Global Indices

Comparative analysis tools enable users to evaluate SP500 performance against other major global indices. The platform’s cross-market analysis features help investors understand international market dynamics and their impact on domestic investments.

Comparison of the FintechZoom SP500 with Other Major Stock Indices

Detailed comparison tools highlight the relative performance of different market indices. Users can analyze correlations, divergences, and unique characteristics of various markets through comprehensive analytical frameworks.

Analysis of How Global Economic Trends Impact the Index

The platform monitors global economic indicators and their influence on SP500 performance. Advanced analytics help users understand the interconnections between international markets and domestic investment opportunities.

FAQ’s

Which companies were added to the S&P 500?

FintechZoom provides real-time updates on index composition changes. The platform maintains a comprehensive database of historical additions and removals, with detailed analysis of each change’s market impact. Recent notable additions are tracked through the platform’s index monitoring system, which provides instant notifications when changes occur.

What is the difference between SP500 and SP500 futures?

The platform offers detailed educational content explaining how SP500 cash index trading differs from futures trading. Through interactive tutorials and comparative analysis tools, users can understand the unique characteristics of each instrument, including leverage implications, trading hours, and settlement procedures.

What is the S&P 500 index fund?

FintechZoom provides comprehensive information about various SP500 index funds, including their tracking methodologies, expense ratios, and historical performance. The platform’s comparative analysis tools help investors evaluate different fund options and their alignment with investment goals.

What is the best SP500 ETF?

The platform’s ETF analysis tools help investors compare various SP500 ETFs based on factors such as expense ratios, tracking error, liquidity, and trading volumes. Through detailed performance metrics and cost analysis, users can identify ETF options that best suit their investment needs.

Summary of FintechZoom’s SP 500 Offering

FintechZoom represents a significant advancement in financial technology, offering comprehensive tools for SP500 analysis and investment. The platform combines cutting-edge technology with user-friendly design to provide valuable insights for investors of all experience levels.

Key highlights of the platform include:

Advanced analytical capabilities powered by artificial intelligence and machine learning Comprehensive real-time market data and analysis tools Sophisticated portfolio management features Extensive educational resources and community support Integrated risk management and strategy optimization tools

Conclusion

FintechZoom has revolutionized SP500 investing through its innovative combination of advanced technology and user-centric design. The platform’s comprehensive suite of tools, educational resources, and community features provides investors with everything needed to navigate modern markets effectively.

The future of SP500 investing continues to evolve, and FintechZoom remains at the forefront of this transformation. Through continuous innovation and enhancement of its features, the platform helps investors adapt to changing market conditions and capitalize on new opportunities.

For investors seeking to unlock the full potential of SP500 investing in the digital age, FintechZoom offers an unparalleled combination of technological sophistication and practical usability. As markets continue to evolve, the platform’s commitment to innovation and user empowerment positions it as an essential tool for modern investing.

Explore the latest news and insights from Echozynth and beyond at Echozynth.com

Kiara Arushi is the dedicated admin of this personal website, which serves as a comprehensive hub for general information across various topics. With a keen eye for detail and a passion for knowledge sharing, Kiara curates content that is both informative and engaging, catering to a diverse audience.

Her commitment to providing accurate and up-to-date information ensures that visitors find valuable insights and practical tips in every post. Whether you’re seeking the latest trends or timeless advice, Kiara’s expertise makes this site a trusted resource for all.